A Stabilised Coin is NOT a Stablecoin

As the world is facing a global crisis yet-to-be experienced in recent generations, people are struggling to find ways to maintain the value of their money. In a blog post we published recently, we explained why the secret to stability is actually pretty intuitive — diversification.

By holding multiple assets in a strategic way, you can at the same time minimize the risk while gaining stability over time, just like you shouldn’t put all of your eggs in one basket, same logic. In other words, asset diversification is essential in maintaining your money’s value in times of crisis.

“But the whole idea about stablecoins is that they’re… Well, stable”. We get that a lot. But here’s the thing — in times of financial soundness, a stablecoin is indeed stable. But when a stablecoin’s underlying currency is fluctuating, so is the stablecoin itself.

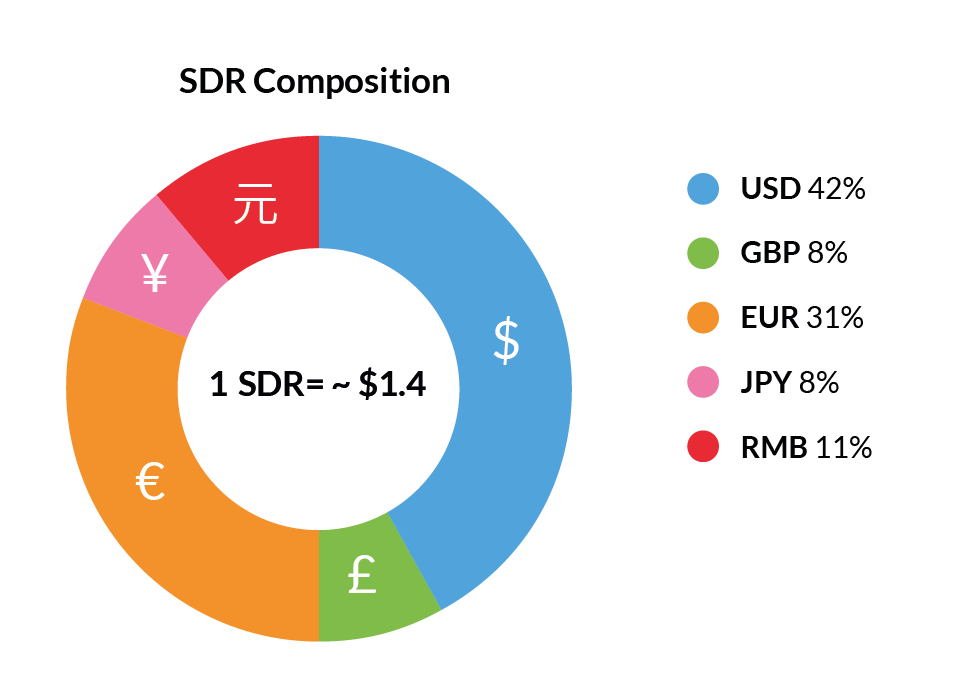

A basket of currencies on the other hand, like the IMF’s SDR — upon which SGA is reliant — is inherently more fluctuation-resistant. No wonder central banks have been using it as a stabilising instrument ever since its creation five decades ago.

“So, if SGA is backed by the SDR, what is the difference between SGA and any other stablecoin?” We get that a lot too. There are three prominent differences.

1st difference

A usual stablecoin is pegged to one asset, be it a national currency or another asset type. It is essentially a tokenised version of that asset, a blockchain-based replication of it. SGA on the other hand, is reliant on the value of a trusted basket of currencies — replicating the composition of the IMF’s SDR (Special Drawing Rights), which has been successfully used for over five decades now by the world’s central banks as a stabilisation instrument. The SDR comprises of the USD, the Euro, the British Pound, the Japanese Yen and the Chinese Yuan, which makes it robust against price fluctuations caused by one currency.

2nd difference

Another major difference between SGA and the usual stablecoin is that SGA is built in a way which makes it gradually depart from its reliance on the SDR — a departure dictated by the SGA’s own market cap — whereas stablecoins remains pegged to their underlying asset. In other words, SGA’s smart contract is algorithmically designed to become an independent currency. This feature makes Saga a bridge between the stablecoin approach, fully correlated to existing assets and the Bitcoin approach of being fully independent and uncorrelated.

3rd difference

Lastly, SGA has a governance model that leaves the control over the coin in the hands of its holders — not in the hands of Saga as the issuer and its backers. Not only is that essentially different from other stablecoins, but it is also a rare case in the entire crypto sphere.

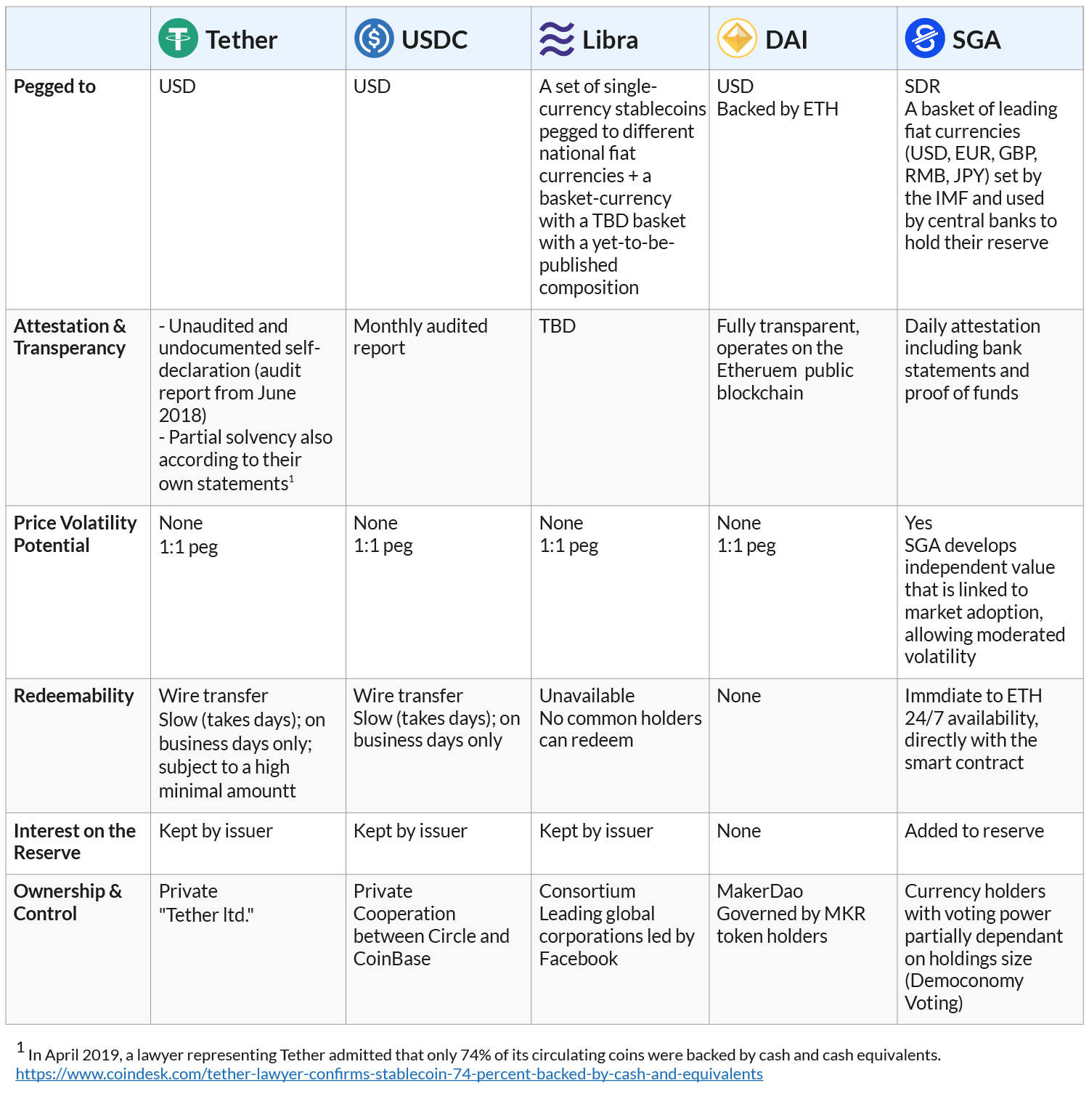

We wish to make it simple for you — to understand exactly how SGA is different from other stablecoins, we need to first layout the differentiators:

Now, in order to provide a bird’s eye view, we have listed these differences between some of the more popular stablecoins (Tether, USDC, Libra, and DAI) here on a table:

These differences make it very clear that SGA is “not just another stablecoin”. Its dependence on a basket of currencies, the fact that it’s progressing towards independence and its unique governance model put it somewhere between traditional currencies and blockchain-based stablecoins.

It’s a category on its own, something more along the lines of “stabilised coin”. And now, after Saga has partnered with Celsius Network, SGA users are now also offered the unique opportunity to earn an interest rate of up to 9.9% a year on their SGA tokens.