SÖGUR’S WHITEPAPER

The cornerstone of Sögur. Here you can find the project’s reasoning, context, and vision - as well as an overview of the mathematical models and technologies underpinning the Sögur economy.

INTRODUCTION

This whitepaper describes a project to design and create Sögur (SGR), a digital token intended to serve as a global currency.

Not issued by a government or private organisation, SGR is issued upon market demand according to predefined algorithms — a feat made possible through blockchain technology. The design and implementation of SGR is performed by Sögur Monetary Technologies Limited, an English limited by guarantee company that works under not-for-profit principles.

The Sögur project aims to bridge between the existing financial system and the new world of blockchain-based currencies. Rather than letting technology dictate function, we use technology as a tool to help achieve our goal of a global currency that complements existing mechanisms for exchanging value.

Given that our project aims to connect two separate worlds of money — traditional and emergent — many readers may not have an intimate knowledge of both. We have a prepared a short introduction to blockchain and an exposition on the history and functions of money as appendices to this document, which some readers may wish to read first.

CHAPTER 1: WHY SÖGUR?

The Need for a Global Means of Exchange

The last few decades have witnessed the breakdown of many boundaries. Commerce, communication and even identities have become less and less confined by nationality or location. The internet era has given birth to communities based more on shared values and interests than shared whereabouts. A global society has emerged, complete with a thriving economy.

Information and ideas now flow more easily than ever across borders; so should value. However, when exchanging value, we still exclusively use currencies designed for national (or regional) economies. The system serves us well for economic activity inside national boundaries, but is less fit for economies that transcend borders. The requirement to operate in multiple currencies in order to function in the global economy is cumbersome. There is a need for a better option; money is supposed to support and streamline economic activity, not hinder it.

Money has always evolved to serve the increasing scope of economic activity. As in the past, the expansion of trade, production, and investment, creates the need for a corresponding scope of money.

Advantages of a Non-National Store of Value

National currencies are designed first and foremost to conform to conditions within the boundaries of their issuance. Monetary policy reacts to local developments such as fiscal policy or the state of the local economy. When exchanging value internationally, these considerations are not always relevant or aligned with a broader global interest.

A global currency would actively reflect and support the global economy without being directly affected by tangential considerations. It would also complement the current stock of currencies in terms of risk diversification. Independent of any particular nation or region, its value would be less susceptible to the vagaries of any single economy, or to the capabilities and interests of any government. Instead, it would be subject to different types of risks and influences.

A priori this is beneficial: one should be able to reap the benefits of money — a convenient way of storing and exchanging value — without having to be directly exposed to the political or economic climate of any one country. Money is not intrinsically related to statehood.

Until recently, the only alternatives to state-issued currencies were currencies issued by private organisations. There have been many such examples across history, but they usually failed due to lack of credibility, limited acceptance, and insufficient trust in the issuer. Today, advances in technology make possible a third option: money that is neither issued nationally nor privately, but algorithmically.

Blockchain & Currency Issuance

As stated, we believe there is a need for a global, non-national currency: one that supports the global economy and acts as a store of value independent of any single country or region. The need could in theory be met by a currency issued by an adequate and credible global authority; but this does not seem a realistic prospect at present.

In the absence of suitable centralised options, blockchain technology provides the ability to create a currency without the need to rely on a national or private entity for issuance. Instead, money can be issued based on predefined rules and algorithms. Implementing such algorithms on a blockchain affords in-built transparency and reliability: currency holders are assured that the crucial functions that control money supply are carried out as designed.

The Search for a Viable, Global Currency

The spread of blockchain technology has led to a rise in digital decentralised tokens, some of which aim to serve as global currencies. Ten years on, we are yet to find one that successfully fills any of the roles of money, let alone all of them.

The most notable attempt at creating a global currency has been Bitcoin. However, the Bitcoin model has discarded key properties of successful currency, instead of adopting or improving them. We identify three important pillars of sustainable currencies that Bitcoin does not fulfil:

- Dependable Value

In the absence of a monetary model, Bitcoin’s volatility is unconstrained. The resulting instability has prevented it from serving as a medium of exchange, even when its market capitalisation has been significant. - Effective Governance

Bitcoin has a crude, inefficient governance mechanism that requires all participants to come to an agreement on all changes. We have witnessed several episodes in which demanding consensus has resulted in slow response times or even forks in the network. - Public Acceptability

Bitcoin’s anarchistic approach — its limited ability to interface with the existing financial system, and lack of compliance with regulation — precludes widespread adoption.

Bitcoin‘s approach is to fundamentally reject the modern financial system, good parts as well as bad. In our view, a new currency must harness the knowledge and achievements of the past in order to have any chance of becoming widely used. It must also contain mechanisms to help it serve as a viable means of exchange: a solid monetary model to support its value; a practical governance framework for administration; and the capacity to become adopted and accepted.

CHAPTER 2: INTRODUCING SÖGUR

Sögur is a project to create and maintain a digital token, Sögur (SGR), intended to serve as a global currency. Our goal is for SGR to serve as a global currency, integrated within the current financial system, governed in the interests of its holders, and endowed with the features to become a true store of value and means of exchange.

In order to achieve this goal, we hope to imbue SGR with all the essential ingredients to function as a real currency: a robust monetary model, an effective system of governance and broad acceptability.

In designing SGR, our approach was to respect and build on the achievements of the past. Drawing on knowledge and expertise from the fields of economics, mathematics, humanities and social sciences, we designed a currency that we believe has the qualities to achieve widespread, global adoption and stand the test of time.

A Global Currency

The expanding scope of global commerce, trade, production and investment raises the need for a global means of exchange, which SGR aims to fulfil. SGR provides a simple method for exchanging value internationally, without operating in multiple currencies.

SGR is not tied to any particular region or state. As a result, it is not directly exposed to the concerns, interests or conditions of any location or government. It aims to provide the services associated with secure store of value to global citizens, regardless of their situation or circumstance.

The need for a global currency does not preclude the need for national ones; these are still the best solution for use within states. SGR is intended to serve as a complement — and not a replacement — of existing currencies.

Taming Volatility

A currency needs a mechanism to ensure that its purchasing power does not change significantly from day to day, otherwise it could never become a means of payment. It does not require a completely fixed exchange rate with any other established currency or basket of goods, but its value should not be erratically volatile either.

SGR is endowed with a monetary model that is designed to support the growth of the economy from its early stages, when it needs most support, until maturation to a fully fledged, independent currency.

The key feature of this model is a blockchain-based, liquidity provider: a smart contract that offers to sell and issue new SGR tokens or buy back and burn tokens. The aim is to dampen volatility while still allowing SGR value to be determined by market forces.

The SGR currency is backed by a variable reserve held in major national currencies in a composition that replicates the International Monetary Fund’s SDR. When the SGR economy is small, most of SGR market capitalisation is backed by the Sögur reserve. Then, as the currency grows, the backing percentage decreases and the economy relies less and less on the reserve.

Sögur’s monetary model is explained later in this whitepaper, and in further detail in an accompanying document on Sögur’s website.

Empowering Governance with Code

One of the primary responsibilities of currency governors is to make decisions in response to changing realities. Sögur’s monetary model, which is to a large extent predefined and algorithmised, defines some of these responses in advance. Our blockchain smart contract maps out precisely how SGR price changes in response to changing supply.

We believe that responses based on well-designed protocol can be preferable to responses made in a purely discretionary manner. For one thing, it reduces uncertainty: parties in an agreement executed by code know in advance exactly what the code will do in different scenarios. Sögur’s monetary model is public: holders know exactly how the bid and ask prices of Sögur’s smart contract are calculated.

Blockchain technology provides the ability to implement algorithmic governance in an assured and honest manner. We run code-based elements of our model on the blockchain instead of on private servers, so that inner workings are completely transparent, and users are guaranteed that what is promised is actually implemented.

Governed in Holders’ Interests

Despite substantial benefits, code cannot perform all the roles of currency governance. It cannot manage Sögur’s reserves or deal with legal issues. Moreover, it is impossible to write code that anticipates and prepares for every situation. At the end of the day, some human discretion is always required.

When we manage things, inevitably issues of bias, self-interest, and lack of knowledge can intrude. Great care must be taken to make sure that these problems are mitigated.

With regard to one of the central roles of currency governance — issuance — SGR already represents a new standard: money that is neither issued privately nor nationally, but according to market demand. When it comes to other elements of governance, we wish to further extend the idea of market control. We view SGR holders as the masters of the currency, so ideally they should govern it. At the same time, management and decision-making should be based on knowledge and expertise that not all holders have, or have the time to acquire.

As described later in this whitepaper, Sögur is planning to introduce a governance model that balances this tension: that allows holders to exercise authority while also supporting expertise-based governance.

Respecting Existing Structures

Sögur works in accordance with all relevant regulatory standards to ensure that regulators' concerns are addressed and answered. In particular, Sögur requires anyone who purchases or sells SGR to or from Sögur’s smart contract to first undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This ensures that Sögur remains a compliant financial operation and can be integrated into the existing financial system.

Backed by fiat-currency reserves held in regulated banks in reputable jurisdictions, SGR relies on the support of existing units of account until it gains its own independent value from the public. Thus, SGR can be thought of as a currency that evolves out of the existing currency system, rather than rejecting it.

We believe our approach of respecting traditional legal and monetary frameworks is crucial for SGR to gain widespread credibility and hence adoption.

CHAPTER 3: SÖGUR MONETARY TECHNOLOGIES

The SGR currency is designed and developed by Sogur Monetary Technologies Limited (“SMTL”), an English company limited by guarantee that works under not-for-profit1 principles. SMTL's purpose is to issue and maintain the functionality of the SGR token in a manner that best serves the interest of the currency holders.

The United Kingdom provides an appropriate venue for Sögur to operate in. We view it as a reputable jurisdiction with competent regulatory framework and forward-looking financial environment allowing Sögur to develop and gain credibility.

Sögur works under not-for-profit principles in the sense that all its proceeds are dedicated in full to promote its objective and cannot be distributed. As a company limited by guarantee, SMTL has no shares or shareholders. SMTL’s corporate structure has been tailored to ensure it serves the interests of the currency holders. Moreover, SMTL is legally bound to work towards full implementation of the Sögur Protocol as described herein.

In other words, SMTL is not owned by any private entity that could potentially monetise the Sögur project. The fact that Sögur’s founding team and board of directors do not own it, ensures that the design and function of SGR reflect the interests of SGR holders alone, without conflicts of interests, biases or distractions.

Saga Core

Development of the Sögur project and certain other operations (e.g. marketing and business development) are provided by Saga Core Ltd, a subsidiary of SMTL based in Tel Aviv, Israel.

Saga Genesis

The process of designing and developing Sögur required funding. We believed the process should reflect the values and principles we wish to promote. As a project that embraces integrity and low volatility, we did not wish to start Sögur with public speculation via an ICO. Accordingly, we decided to approach only accredited/qualified investors and major venture capital firms as early contributors to the Sögur project. This also allowed Sögur to benefit from a wide range of knowledge and support.

In order to compensate early backers and other stakeholders, we created a second token called Saga Genesis, SGN. Saga Genesis is a voucher token that can be converted to SGR at will. The amount of SGR received upon conversion is pre-modelled and depends on the size of the Sögur economy: the amount starts at zero, and only increases if the SGR economy achieves real success2. This ensures the interests of SGN holders are fully aligned with those of SGR holders.

Saga Genesis is designed to limit its impact on the SGR economy. The SGN-to-SGR conversion ratio is capped, so the combined influence of SGN holders is limited. In order to reduce the influence of any single entity, the size of contributions were also capped.

CHAPTER 4: MONETARY MODEL

This chapter gives a general overview of Sögur’s monetary model. A more expanded description can be found in Appendix C of this document, and a complete description in a document entitled ‘Sögur Monetary Model’ on Sögur’s website.

Introduction

The purpose of Sögur’s monetary model is to ensure that SGR becomes a fully fledged, standalone currency. In order to achieve this, there must be a sufficient degree of stability in SGR value; no one will accept SGR as a means of payment if its value fluctuates excessively. On the other hand, there is an inherent tension between this goal and another function of currency: store of value. In general, a good store of value has the ability to appreciate. It is also appropriate that value should change to reflect a currency’s strength and usefulness.

Sögur’s monetary model aims to balance these opposing elements of stability and growth. The aim is not to force SGR value to be static, but rather to moderate price fluctuations so that they respond to economic forces, and not just market speculation.

It will take time for Sögur’s currency to gain credibility in the eyes of the public. To support the currency, tokens are backed by a reserve kept in prominent fiat currencies. Mechanisms to stabilise value are strongest while the currency remains small.

SGR Liquidity

The Sögur currency includes a liquidity provision mechanism, intended to dampen the effects of market forces when they cause volatility in SGR value. Sögur’s blockchain smart contract offers to sell new SGR tokens at all times, at an ask price determined by Sögur’s monetary model. Conversely, the contract offers to buy back and destroy SGR tokens at our model’s bid price.

Thus, supply of SGR tokens is determined by demand: tokens are issued or removed from circulation as the market determines. In addition, SGR value lies3 in between the model’s bid and ask prices. Within the range determined by Sögur’s smart contract, transactions can take place in secondary markets, without involving the contract.

The bid and ask prices of Sögur’s model are not fixed. They increase as more tokens are bought from the contract, and decrease when tokens are sold back. The pricing function is dependent solely on the number of tokens outstanding. As a result, the pricing model is path independent: SGR price depends solely on the current state of the economy, and not how it got there. This prevents potential manipulation and unfair gaming

The proceeds from issuing new SGR tokens are kept in full in a reserve. The reserve is generated solely from selling SGR tokens, and its sole purpose is to give Sögur’s smart contract the ability to buy back tokens when necessary. Costs4 of maintaining the reserve are drawn from the reserve itself.

The reserve is stored in liquid, low-risk assets whose composition replicates the International Monetary Fund’s SDR. We use the SDR as our unit of account, following the example of the IMF and other global organisations.

Reserve Ratio

When the price of SGR rises, all tokens are traded according to the new valuation, despite the fact that some tokens were originally issued at a lower price. The result is that the Sögur reserve — the cumulative net proceeds of SGR token issuance — contains less money than SGR’s market capitalisation — the value of all SGR tokens in circulation.

The reserve ratio is defined as the proportion of SGR market value that is backed by Sögur’s reserves. It represents5 the level of confidence that the market places in the SGR currency, 5 independent of the backing reserve.

For example, when people buy SGR knowing that the Sögur reserve only contains 80% of the market value of SGR, it is because they believe SGR also has its own inherent value; otherwise they would sell SGRs back to Sögur’s smart contract. Confidence in the independent value of SGR must be even greater if the market trades SGR when the reserve ratio is lower — 50%, say. In this case, the inherent value of SGR — its usefulness as a currency, its credibility and acceptance — accounts for half of its total value.

The reserve ratio also represents the extent to which the Sögur smart contract can impact SGR price. When the reserve ratio is high, Sögur’s liquidity-provision function has great power to dampen price fluctuations. When the reserve ratio is lower, SGR’s value is to a greater extent derived from and therefore exposed to market confidence; the reserve plays a smaller role in stabilising price movements.

The Sögur reserve always remains solvent by design, even when the reserve ratio is less than 100%. When someone sells an SGR token back to the smart contract, money that was deposited into the reserve when the last token was issued, is withdrawn to reimburse the seller. As more tokens are sold back, the bid price of Sögur’s smart contract decreases in a similar manner to how it originally increased when the economy grew.

Variable Fractional Reserve

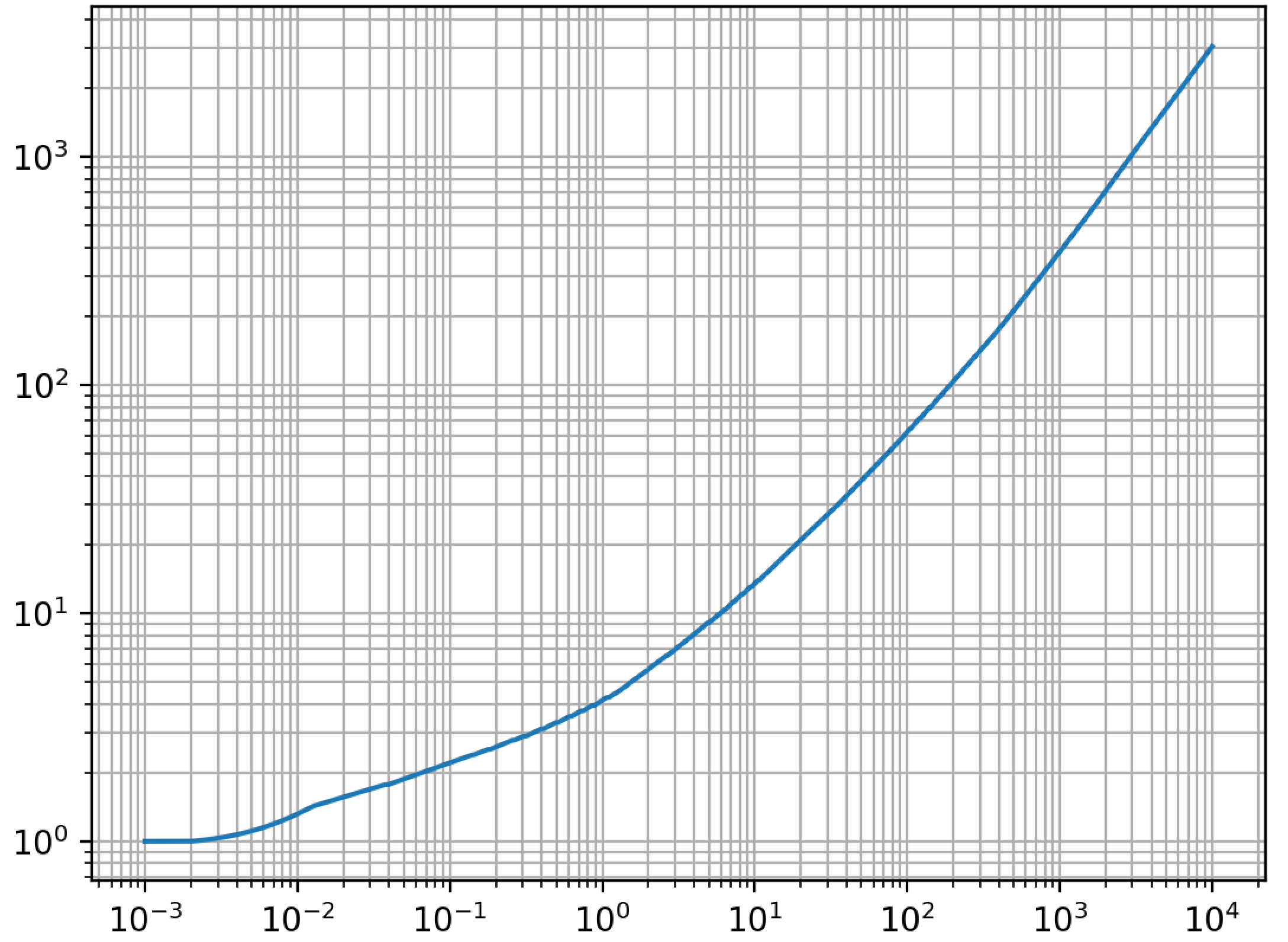

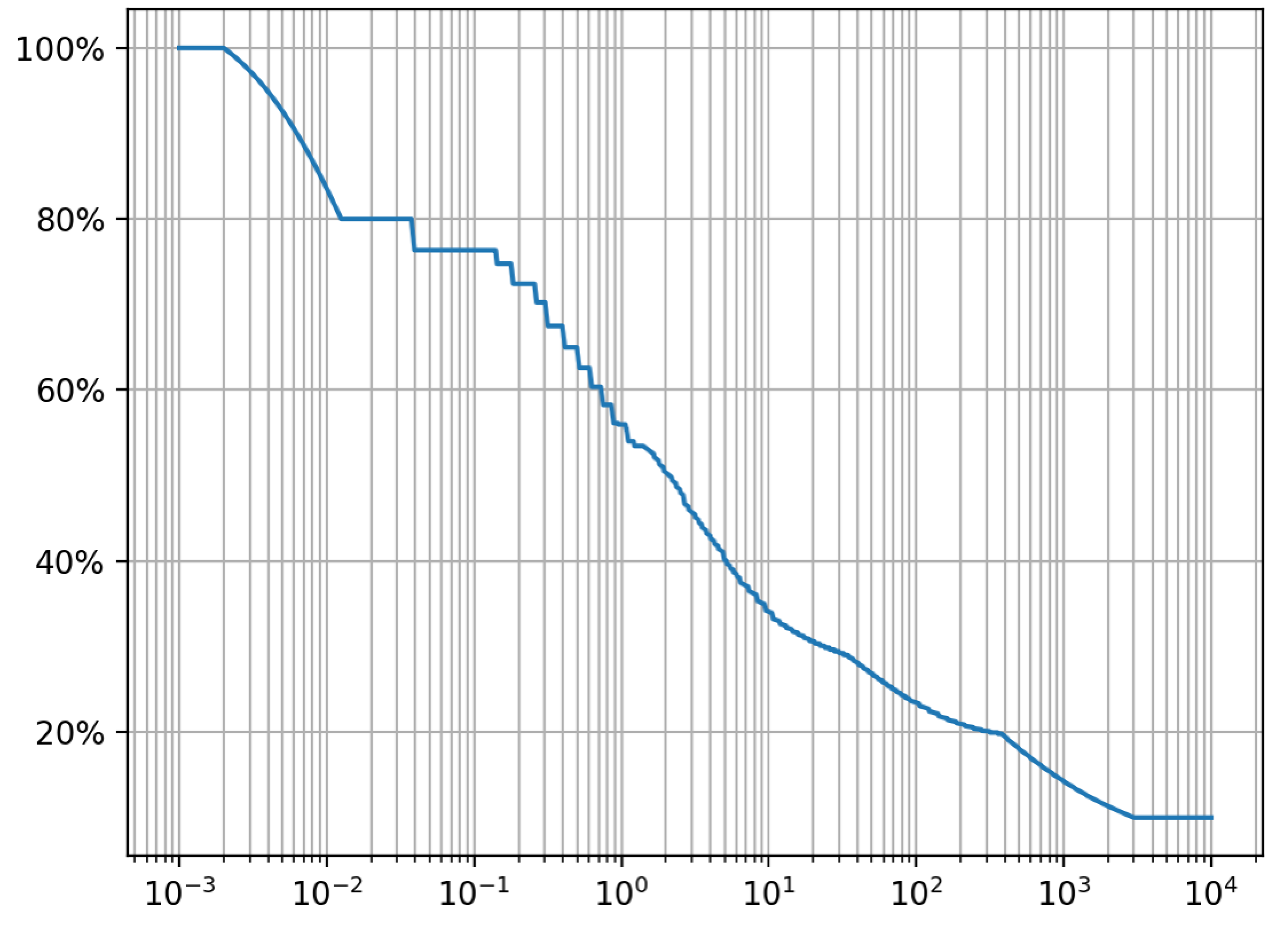

Sögur’s monetary model is based on a variable reserve ratio. It remains at 100% for the first 2 million tokens sold. At this stage, full weight is given to the reserve backing. SGR value is fixed, and does not reflect changes in market confidence. Then, as more SGRs are issued, the reserve ratio is gradually decreased reflecting the increase in SGR market trust. The reserve ratio declines slowly until it reaches a minimum of 10%, when SGR market capitalisation is 3 trillion SDR.

Finally, once SGR market cap reaches first-rank prominence, it will no longer make sense to benchmark SGR value against the reserve. A new permanent system, to be determined as needed, will secure SGR as a standalone currency.

In this respect our model mimics the evolution of other currencies: from fully backed by tangible assets (e.g. gold standard); to fractional reserves; to backed solely by the standard of its governing authority.

Supporting & Counter-Cyclical Measures

Keeping the reserve ratio at 100% when the Sögur economy is small puts all early participants on an equal footing and prevents a ‘run on the contract’. Thereafter, the reserve ratio declines in accordance with growth of SGR’s market value. As long as market confidence in SGR is deemed small, the reserve ratio remains high. The value of SGR tokens is then highly protected: fluctuations in market capitalisation cause only small fluctuations in SGR price.

When SGR tokens are sold back to the smart contract due to lack of demand, SGR price drops and the reserve ratio is increased. Our model employs a higher reserve ratio in a shrinking economy compared to its initial growth. This is intended to act as a countercyclical element to encourage a recovery: higher reserve backing provides extra support to Sögur’s shrinking economy, and should decrease the incentive for continued selling.

Interest and Price Adjustment

The Sögur reserve is held at major banks, where it accrues interest. The net interest accrued to the reserve would be reflected as a corresponding change in the value of SGR.

For example, if the reserve account receives income, then the price set by Sögur’s smart contract will be increased by the same percentage. This way, SGR holders can benefit from the time value of money.

Price Band

SGR valuation in secondary markets is free to fluctuate within the band formed by our model’s bid and ask prices.

While Sögur’s economy remains small, a narrow price band is enforced; the contract effectively controls SGR price. The width of the price band increases as Sögur’s economy strengthens, affording a greater role to the free market to determine SGR value.

While Sögur’s economy remains small, a narrow price band is enforced; the contract effectively controls SGR price. The width of the price band increases as Sögur’s economy strengthens, affording a greater role to the free market to determine SGR value.

Saga Genesis

Saga Genesis tokens (SGN) are voucher tokens convertible to SGR. The conversion ratio — the number of SGR tokens received when converting an SGN token — is dependent on the size of the SGR economy.

SGR tokens are created for SGN holders at various milestones in SGR market cap, which we call Minting Points. Whenever the SGR economy reaches a new Minting Point, signifying that the SGR currency has achieved additional success, tokens are automatically generated by Sögur’s smart contract and kept aside for SGN holders. SGN holders can at any time convert their SGN token in return for the SGR tokens that have been minted thus far.

The Saga Genesis mechanism was designed to preserve the interests of regular SGR holders and to limit the ability of SGN holders to influence the SGR economy. The percentage of SGR tokens minted for SGN holders is never higher than 30% of the total SGR tokens (at the time of their minting). This represents a significant improvement compared to other digital currencies, where it is not uncommon for a small number of wallets to own the vast majority of tokens.

Each SGN token can only be converted into SGR once. This incentivises SGN holders to stay and support the SGR economy rather than take short-term profits.

Like the rest of Sögur’s monetary model, the SGN mechanism is pre-determined and visible on the blockchain.

CHAPTER 5: GOVERNANCE POLICY

Currency represents an agreement — the agreement to accept a certain form of money as payment. Like all agreements, a currency requires an authority to implement, maintain, protect and occasionally adapt it.

We divide the duties of currency governors into two main roles:

- implementation / maintenance of existing currency protocols.

- modifying protocols when necessary to respond to changing realities.

In this chapter we detail Sögur’s approach towards these two tasks.

The introduction of blockchain, now over ten years ago, has created much debate about the virtues of decentralised governance versus centralised methods: between sharing authority amongst all members of a project or concentrating to a smaller number of entities.

Sögur’s general approach is to look for a suitable middle ground that balances between the impartiality and transparency promised by decentralisation and the efficiency of central entities.

Implementing the Sögur Protocol

Sögur’s monetary model is based largely on algorithms. When it comes to implementing these as computer code, the centralised approach is to operate on a private server. The prevailing decentralised method is to run on a blockchain. Each has its own benefits and drawbacks.

When implementation is done on the blockchain, code is guaranteed to run as written. This transparency assures users that what they have been promised will actually be carried out. On the other hand, there is an inherent inefficiency of running on a distributed network; the cost and impracticality of having to run all operations on all nodes.

Blockchain is useful when there is a clear need for ownerless and distributed code — otherwise running on a private server is clearly more practical. In Sögur’s model, our liquidity provision mechanism, which allows participants to determine SGR supply and pricing, is deemed sufficiently important to merit operating on the blockchain. We use a fully decentralised approach so that participants do not need to trust anyone to be certain that code-based elements of our model are implemented as described.

Not all parts of Sögur’s model are based on computer code. Parts of Sögur’s operation involve interactions off the blockchain, for example, management of the reserves and interactions with regulators. These are carried out by Sögur.

Even when implementation occurs off-chain, we aim to emulate the transparency of blockchain as much as possible by sharing details with SGR holders. As an example of such, we require the banks that hold our reserves to make daily attestations of the balance of Sögur’s accounts, so that users have independent verification and do not rely solely on Sögur’s report.

Updating the Sögur Protocol

In an ever-changing world, the SGR currency cannot rely on a static model. Code-based elements of our model are blind to changes and developments and may need to be modified occasionally. Other changes, such as dealing with new regulatory demands, cannot be made by algorithms. In order to successfully keep up with the times, the SGR currency must have a system for decision-making.

The fully decentralised approach is again embodied by the blockchain. There is no way to make changes to a blockchain contract’s inner workings. The only option is to fork: to create a new network with the changes incorporated. All participants then have to decide whether to migrate to the new version, or to continue operating with the original code. This has the benefits of full representation: changes cannot be made to an agreement without all participants actively agreeing first. On the other hand, the blockchain method of decision-making is incredibly primitive. If a split to the network is to be avoided, all users have to agree to all changes, which could take a prohibitively long time, if at all.

Delegating decision-making to a centralised body is clearly more efficient. It also allows for the possibility of decisions taken by experts. However, centralised decision-making always brings with it the principal-agent dilemma: how to ensure the interests of representatives are truly aligned with those they represent.

Sögur believes there is an adequate middle ground: a way of mitigating the problems of agency without removing the agent altogether.

An Interim Governance Policy

Both management and modification of Sögur’s model require the involvement of Sögur. Given that we view SGR holders as the true masters of the currency, Sögur’s board of directors ideally should be made up of their appointees. We wish to create a suitable, delegates-based governing framework for Sögur that respects the right of holders to influence decision making whilst also maintaining efficiency and expertise.

Sögur has formed a research institute whose first task is to seek and design a suitable organising framework for Sögur. This framework is described in a separate document - Sögur’s Governance model, that includes details of the proposed governing bodies and their makeup, along with measures to ensure that governors truly represent the interests of holders: incentive mechanisms, checks and balances, and a high level of accountability to holders.

Since the formation of a new governance structure is a delicate process, demanding the highest level of expertise as well as substantial funding, the full suggested governance framework won’t be formed at once. Instead, it will evolve in a series of intermediary stages. A Provisional Constitution establishes the core principles, rules and norms upon which the Sögur operation functions during these in intermediary stages.

At the initial stage, an intermediary board of directors was set up for overseeing SGR’s implementation and for making decisions in accordance with its fiduciary responsibilities.

The intermediary board of directors will only make changes to Sögur’s monetary model in extreme cases. Sögur’s monetary model is already well equipped and programmed to handle a wide variety of possible future events. For example, the model defines exactly what the reserve ratio and price of SGR will be at every stage of Sögur’s development. This reduces the likelihood of unforeseen events that require changes to our model.

As part of our commitment to moving to a more inclusive system of governance, currency holders will be able to replace the intermediary board of directors and elect a new board of directors starting a year from the launch of the SGR currency. This is the first milestone in the gradual formation of Sögur’s long term governance model, as is detailed in the Governance Model document.

Starting September 2020, Sögur moved into its second intermediary governance phase in which an Assembly of currency holders was formed and some of the intermediary board of directors decision making rights were given to the Assembly, allowing token holders to take greater control of the project.

CHAPTER 6: INTEGRATION WITH THE EXISTING SYSTEM

An essential component of any currency is adoption. A currency — no matter how good its monetary or governing frameworks are — is not a currency unless people are willing to own it and accept it in return for goods and services. Thus, acceptability is key.

However, it is also difficult to accept the new, especially with something as crucial as money. Trust must be earned, and this takes time. In order to have any chance of achieving adoption, the concerns of the existing establishment must be respected. In our view, new money that clashes with traditional frameworks instead of collaborating with them, will eventually fail. Moreover, there are many aspects of the existing system that are beneficial and should be maintained.

Economically, we embodied this approach in our monetary model. The SGR currency does not attempt to rely on market trust from day one. Instead, it borrows credibility from the established currencies that make up Sögur’s backing reserve while it gains its own independent value.

Our volatility-taming mechanism addresses the major concerns of economists with regard to new digital currencies — that of market stability. In this chapter we detail measures taken to address the concerns of public-policy makers and financial regulators. As the safeguards of public acceptability, satisfying the demands of regulators is crucial for gaining widespread adoption.

Identity is Accountability

Sögur’s currency is non-sovereign in the economic sense; we believe there is a benefit to a currency whose value and governance are independent of any nation. Within the digital currency community, many link economic non-sovereignty to legal non-sovereignty: they seek currencies that are also independent of the laws of nations. We do not share this view.

Sögur proposes an alternative monetary system, not an alternative law. We do not presume to be able to arbitrate between participants of Sögur, nor to decide or enforce appropriate usage of SGR. Traditional regulatory frameworks will determine how Sögur fits in to the existing legal and financial establishment. Sögur must therefore provide regulators with what they need in order to enforce their laws.

Until now, a major concern of regulators has been the anonymity of digital currency holders. Identification of participants is key for enforcing accountability so it is not surprising that regulators have so far shunned new currencies that have not given them the tools to prevent money-laundering, tax evasion, or the general undermining of the law.

To address this concern, Sögur’s currency has identity built into it. In order to buy or sell SGR to and from the smart contract, a participant must first undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) processes with Sögur. Then, upon requests from regulators, Sögur can confirm the owner of any wallet that bought or sold SGR from or to Sögur.

Rejecting Anonymity, not Privacy

Whilst the ability to identity participants is essential, privacy must still be paramount and rigorously protected. Sögur stores KYC information in an encrypted Trusted Zone and the unveiling of identity is restricted to the purpose of compliance with applicable laws.6

Integration in Practice

While other solutions might consider KYC and AML procedures a price they are willing to pay for acceptability, we consider it a justified and necessary step towards maintaining responsible citizenship.

However, one cannot deny that the need to perform KYC and AML procedures constitutes a barrier to participant entry. To make matters easier, Sögur commits to offering an online onboarding service, adherent to strictest regulatory standards but faster and simpler than traditional banking procedures. This allows us to remain compliant without deterring participation in Sögur. As is the case with existing fiat currencies, the transfer of existing SGR in the secondary market does not require performing any additional procedures.

In practice, as part of Sögur's mission, it intends to comply with all regulations and legal requirements under applicable regulatory framework including the adoption and implementation of applicable Financial Action Task Force (FATF) and AML/CTF requirements.

CONCLUSION

Rapid advances in technology, society and economy have for the most part bypassed our money, which has remained basically unchanged for centuries. Its form has advanced, with bills replacing coins and electronic transfers replacing paper checks, but its essence has remained the same. As J. M. Keynes commented, for at least hundreds of years our system has been a “state money system”.

While economic activity — trade, production and consumption — is increasingly global, money remains bound for the most part by national borders. The monopoly of currency by states, gives us no choice but to stake portions of our personal value on the fortunes of a particular nation or group of nations.

Decreasing importance of national boundaries, changes in society, and a need for monetary diversification have created the necessity for a complementary, global, non-sovereign currency. Technological advances have provided the means to achieve this. Incorporating a rules-based, transparent monetary model with good governance and regulatory acceptance, Sögur stands for necessary yet prudent evolution of money. Building upon the past while respecting the present, Sögur represents continued progress.

Looking Ahead

Society and technology are constantly changing, and we do not know what the future will bring. The increasing pace of technological and social change calls for money to continue to evolve, adapt and improve. Digital currencies have great potential to become ever more sophisticated, providing substantial benefits to society and economy. There are many possibilities for digital currencies to develop new and useful features.

The fact that digital currency can be programmed and endowed with new functionalities has great potential. It can be customised to serve specific purposes, or be limited to prevent abuse or misuse. Its near limitless divisibility and transferability make possible economic activity which is not feasible today, which can encourage creativity and commerce.

Sögur itself will need to evolve, and that ability is inherent in its model. Sögur’s governance is designed to deal with change while remaining true to basic principles. As technology develops and new platforms emerge, Sögur will be able to engage them and maintain progress towards an improved and promising tomorrow.

DISCLAIMER

The provision of information in this communication is not based on your individual circumstances and should not be relied upon as an assessment of suitability for you of a particular token, product, service, or transaction. It does not constitute investment advice, tax advice or legal advice and Sögur Monetary Technologies Limited and/or Saga Core makes no recommendation as to the suitability of any of the tokens, products, services or transactions mentioned herein. This communication shall not be considered as, and may not be used in connection with, an offer to sell or the solicitation of an offer to buy tokens in any jurisdiction in which such offer or solicitation is unlawful. Purchasing, holding and using virtual currencies involve a high level of risk. Please see our full Risk Disclosures, as detailed on Sögur's Terms of Use.

APPENDIX A: MONEY - IT’S ROLE, IMPORTANCE AND EVOLUTION

This appendix presents a short survey of the functions and properties of currency. It is far from exhaustive, but provides a useful background for issues discussed in this whitepaper.

Money’s Role in the Economy

Money is an essential feature of any modern economy and serves three primary roles:

- Medium of exchange

- Store of value

- Unit of account

As a means of exchanging value, it is key to almost all economic relationships and processes. It widens the ability to trade by making transactions more convenient, safer, and easier to evaluate. Without efficient transactions, only a primitive economy would be possible, limited to barter. Production would be inefficient, trade difficult, choices severely constricted by geography and happenstance.

As a store of value, money is the essential and basic component of the financial system. It makes possible both saving and investment, without which growth and progress would be curtailed.

As a unit of account, money provides a way of measuring and comparing the value of items. This is the basis for economic decision making, enabling superior allocation of resources and consumption choices.

Money’s Role in Society

Aside from its role in the economy, money plays an important role in any well-functioning society. It facilitates wide and extensive interaction between a society’s members, both individuals and institutions. Historically, it has connected geographically distant areas and allowed for exchange not only of goods and services, but also of ideas, culture and cooperation.

History of Money

Money, like other inventions and social constructs, has constantly evolved along with society and technology. By adapting itself to changing environments, increasing its scope and growing in sophistication, it has become ever more useful, and ultimately essential to all societies. It has both contributed to and benefited from progress over time.

Initially, societies without money exchanged value through barter. As barter expanded in extent and variety, certain frequently traded and widespread products began to assume a larger, symbolic role; convenient-to-transport, durable, easily valued and measured goods became widely used as proto-currencies. Salt is a good example. Starting as something with intrinsic value — metals such as silver or gold — money later became increasingly more symbolic: seashells, tally sticks, and eventually coins and bills.

At times private in nature, money issuance was so important it eventually became a monopoly of government. Sovereign currencies did not immediately gain trust, but needed some form of external backing. The gold standard provided backing in the form of precious metal reserves. Currency boards are backed by another, more credible currency. The Bretton Woods system saw the value of most currencies linked to the US Dollar. Over time, as sovereign currencies gained independent credibility, the amount of such backing, or the reserve ratio, declined.

Today, most nations issue fiat7 currencies, money backed only by the standing of its issuer, and backing reserves are minimal and irrelevant — except when trust evaporates and a crisis ensues. With no intrinsic value, modern fiat money is based primarily on trust.

What is Currency Governance?

Currency may be regarded as a social contract: it is an agreement amongst members of a society to use and accept a particular form of money. Like all contracts, currency requires governance — a process that implements, enforces and occasionally modifies the agreement. Currency governance includes: issuing new currency units and managing supply; combating forgery; improving efficiency of exchange or storage; and most importantly, protecting the currency’s value.

Money has rarely if ever had value in and of itself. An integral part of the currency contract is the willingness to exchange items — coins, bills or entries in bank ledgers — for more than their intrinsic worth. The system only works if there is widespread confidence that a currency will retain its value into the future.

Confidence is difficult to acquire and must be actively maintained. Governance is the only thing that prevents currencies from being left solely to the winds of public sentiment and unlimited volatility. It is what ultimately gives people the confidence to use a currency as a means of exchange and store of wealth.

The strength of a currency is directly related to the quality of its governance. Anyone can write an IOU – “I Owe You five Ducats”. Only if a large enough number of people are willing to rely on the issuer and accept the IOU as payment does it become money. As the prominent economist Hyman Minsky commented, “Anyone can create money…the problem lies in getting it accepted”.

APPENDIX B: BLOCKCHAIN AND ITS POTENTIAL

This appendix presents a description of blockchain technology and its capacity to enable applications with in-built transparency and reliability.

Our aim is to present blockchain in simple, down-to-earth language, focusing on what it can be used for, rather than on the technical details of how it works.

What is a Blockchain?8

Blockchain is best described with an analogy: it can be thought of as a computer shared by members of a community. No single person owns the computer, and everyone in the community can see how the computer is used. Members of the community can write programs to run on the computer. They can store data or define functions, and specify who is permitted to run their functions. In theory, a blockchain can do anything that a regular computer can do, the only difference is that the computer is not privately owned.

In reality a blockchain is actually a network of many computers (usually referred to as ‘servers’) that store and maintain the same data. Maintainers of the network — often called miners — work by protocol: whenever a user makes a request to run an operation on the blockchain, miners check that the request is valid9 and if so each performs the operation on their server as requested. Since all servers in the network store the exact same information and carry out the exact same functions, it is appropriate to think of them all as just one computer.

Why Use a Blockchain?

The main principle of blockchain is that it is decentralised: instead of running programs on just one or a small number of private servers, programs run on multiple computers across a network. This comes with tradeoffs of efficiency and cost10. The fact that all operations on the blockchain are publicly visible limits the ability to run applications that include sensitive information or valuable intellectual property.

Blockchain is useful in places where decentralisation is worth the sacrifices mentioned above. We view two main benefits of running applications on a blockchain:

- Reliability

Working on a network of computers is more reliable than relying on one organisation to store and maintain data. Validation of operations is performed by all computers across the network, and data is also less likely to get lost. - In-built trust and transparency

The inner workings of programs that run on the blockchain are completely exposed. Anyone can examine their underlying logic and learn exactly how they operate. Blockchain is often described as a way of bypassing trust: instead of having to trust a programmer or organisation that their code functions as claimed, you get to see the code for yourself. However, blockchain is not only for the untrusting or anti-institutional: anyone can benefit from an inherent guarantee that a program functions properly, instead of having to rely on the honesty of programmers, or their desire to stay in business, or in extreme cases, the law.

Use Case: Smart Contracts

The introduction of blockchain has led to a rise in the implementation of so-called smart contracts. These are contracts whose terms and conditions are written in code and implemented as a program on the blockchain.

Consider a simple contract for buying and selling tickets to a concert. The contract asserts that anyone who sends the right amount of money to the organisers will have their name automatically added to the guest list for the concert. This contract could easily be implemented as a computer program.

The organisers of the concert could run their ticket-selling program on their own private servers or they could run it on the blockchain. If they choose to run on their own servers, a number of potential problems could in theory occur:

- The organisers could be scammers: they could take money from some people and not put their names on the list.

- The organisers’ servers could malfunction. For example, the guest list could be deleted.

- The implementation of the program could have ‘bugs’ — some people may not have their names added to the list due to some unintentional error in the programming.

If the organisers instead choose to run on a blockchain, none of these problems could occur. The code of the program could be checked in advance by the users to confirm that when money is sent, names are indeed always added to the guest list. Moreover, if the guest list is stored on thousands of servers it is unlikely to get lost.

Here, the blockchain does not necessarily solve any problems that were unsolvable before. When programs are not run on the blockchain we can always contact a company's support service if there is an issue, or appeal to the law in the case of scammers. But it is more reassuring, potentially less expensive and certainly less time consuming if these problems simply cannot occur.

APPENDIX C: FURTHER DETAILS OF SÖGUR'S MONETARY MODEL

Sögur’s monetary model is designed to support the SGR currency and to provide confidence, especially when the currency is still small. Its main features include a reserve held in fiat currencies and a blockchain-based mechanism for ensuring SGR liquidity and mitigating excessive volatility.

At all times, Sögur’s smart contract offers to sell new SGR tokens or to buy back and burn existing tokens at prices that reflect the strength of the Sögur economy. This allows the market to determine the supply of SGR while reducing volatility by constraining price to lie within the contract’s bid and ask prices.

The proceeds of selling SGR tokens are kept in a reserve whose purpose is to back SGR with a basket of established sovereign currencies while the currency grows and gains its own independent trust. Funds in the reserve are what enable Sögur’s smart contract to buy back SGR tokens when necessary. Sögur’s reserves are held in fiat currencies in regulated banks in reputable jurisdictions.

When more tokens are bought from the Sögur smart contract, bid and ask prices of the smart contract increase. Similarly, when tokens are sold back, the price of SGR is reduced in an opposite manner.

Reserve Ratio

When the price of SGR rises, all SGR tokens are valued at the new price, even though most tokens were originally issued for less. As a result, Sögur’s reserve does not contain the full market capitalisation (cap) of SGR. In other words, Sögur’s reserve ratio is less than 100%.

The concept of a reserve ratio less than 100% in the context of Sögur requires elaboration to avoid confusion. A reserve ratio of 95%, for example, does not mean that 95% of the proceeds of issuing SGR are deposited into the reserve and that the remaining 5% are syphoned away for some other use. Rather, proceeds are always deposited in full into the reserve; the drop in the reserve ratio happens because the Sögur contract raises the price of SGR. In other words, it is SGR holders that gain when our model reduces the reserve ratio — through a rise in the value of their tokens.

Similarly, a reserve ratio of 95% does not mean that the Sögur contract will only redeem 95% of SGR tokens and then become insolvent. Instead, the smart contract reduces the price of SGR as tokens are sold back in an opposite manner to how price increased when the economy originally grew. Thus the contract always has the means to buy back all SGR tokens, albeit at a decreasing price.

Reserve-Ratio-Based Pricing Model

Our pricing model for Sögur’s smart contract was designed by first choosing how the reserve ratio should decrease as the economy grows, and then deriving a price function that generates this behaviour.

Reduction of the reserve ratio reflects increased confidence in the SGR token. Indeed, our model only decreases the reserve ratio when more SGR tokens have been bought, indicating increased demand and trust. When the reserve ratio is reduced, SGR value no longer stems entirely from the backing reserve. SGR gains its own value as an independent means of exchange and store of value, and therefore our model allows SGR market cap to exceed the amount of money in Sögur’s reserves.

The result of decreasing the reserve ratio is an increase in SGR price. As a simplified example of how SGR price can be derived from the amount of money in the reserve and the reserve ratio, see the table below. Note that numbers displayed here are for demonstration only and do not bear any resemblance to Sögur’s actual model (shown further below). In practice, our model reduces the reserve ratio continuously, and not in jumps, and consequently the price of SGR increases continuously as well.

Consider the second row of the table. At this point, one million tokens have been issued at a price of 1.00. The Sögur reserve therefore contains 1.00M. We wish to reduce the reserve ratio to 95%. Therefore the market cap of SGR must equal 1.05M (so that the reserve value is 95% of SGR market cap). There are one million tokens in circulation, so for their combined value to equal 1.05M, the contract must raise the price of SGR to 1.05.

Sögur Monetary Model in Tables' & Figures

The following figures and table give an overview of Sögur’s actual monetary model as the currency grows.

It is important to note that while Sogur Monetary Technologies does not derive any profits from the project, early backers and other stakeholders of the project are compensated for the risks they have assumed. To maintain alignment of interests, compensation is conditioned on the success of the SGR currency.

The Saga Genesis mechanism is fully transparent on the blockchain. Full details can also be found in a document titled Sögur’s Monetary Model amiable on Sögur’s website.

Assuming no market arbitrage opportunities.

Mainly bank transactions costs and blockchain gas fees.

Or more precisely, one minus the reserve ratio.

For more details, see Sögur’s Privacy Policy on Sögur’s website.

From the Latin “let it be done”, i.e, created by the word.

Note, there are in fact many types of blockchain. Here we describe public blockchains that can carry out smart contracts - Ethereum being the most notable example at present. These sufficiently convey the overall potential of blockchain.

For example that the user actually has permission to run the operation.

Requests to run operations on a blockchain typically incur costs to the user, usually direct compensation to the miners that maintain the network.