Why What you Think is Stable is Not Really Stable at All

Global markets have been enduring a rocky week, to put it mildly. The coronavirus spread, coupled with oil price wars, have put a dent in everything from stocks to commodities. Fear is also contagious, it transpires, and when world markets nosedive, few assets are spared.

Cryptocurrency traders who sought sanctuary in USD-pegged stablecoins will have escaped the worst of the downturn, which shaved 33% off BTC in a week. If you were one of those who swapped volatile cryptocurrencies for stable currencies, you should know that in doing so you’ve merely moved from one volatile asset to another. The US dollar — or its stablecoin equivalents — have not been faring so well themselves. Sure, 1 USD is still worth 1 USD, but when measured against other global currencies, the greenback doesn’t look so solid.

Some Stable Currencies Are More Stable Than Others

US Treasury bonds yields hit new lows on Monday, and oil prices were floored as the markets endured their worst day since 2008. In times of economic crisis, hinging your fortune on the fate of any single fiat currency is folly. Central banks have been aware of this lesson since 1969, when the IMF’s Special Drawing Rights was created.

Ever since the 1970s, when the gold standard was dropped, all national currencies have operated as “floating currencies” in that their value can only be established by comparing it to other currencies. If one currency is going down, it stands that other currencies must go up relative to it. This is why the IMF’s SDR, comprising a basket of currencies, should remain more stable over time than any one of these currencies alone.

Stability on the exchange rate is no longer maintained, as US markets have been buffeted, but to throw all of your net worth into EUR instead of USD makes zero sense either. It’s a play which might serve you well in the short-term, but is unlikely to play out well over time; with the whole of Italy on lockdown due to the coronavirus, European banks in trouble, Russia plotting with Saudi Arabia, and discontent forming on the Greek border, the old continent has its own troubles to deal with.

USD/EUR Ratio — Sept. 9, 2019 — March 9, 2020

For the last 2 weeks (Feb. 24 — March 9, 2020) people that had their holding in USD lost 5% of their money’s worth compared to the EUR

Diversification Through a Single Asset

For crypto traders seeking the highs and lows of the market, BTC is the perfect asset. But if stability is what drives you in these most unstable times, it makes sense to diversify into less volatile assets, and it doesn’t get more balanced than the SDR’s diversification of national currencies. While you can’t directly access SDR within the cryptoconomy, you can acquire its surrogate — SGA, the low volatility crypto-asset whose reserve is based on the same basket of fiat currencies and at the same ratio.

There’s a reason why Saga (SGA) has been one of the most stable digital assets while the rest of the market has been racking up double-digit percentage losses. The low volatility crypto asset, whose reserve attestations emulate the SDR basket of currencies, proves its worth in times of economic turmoil.

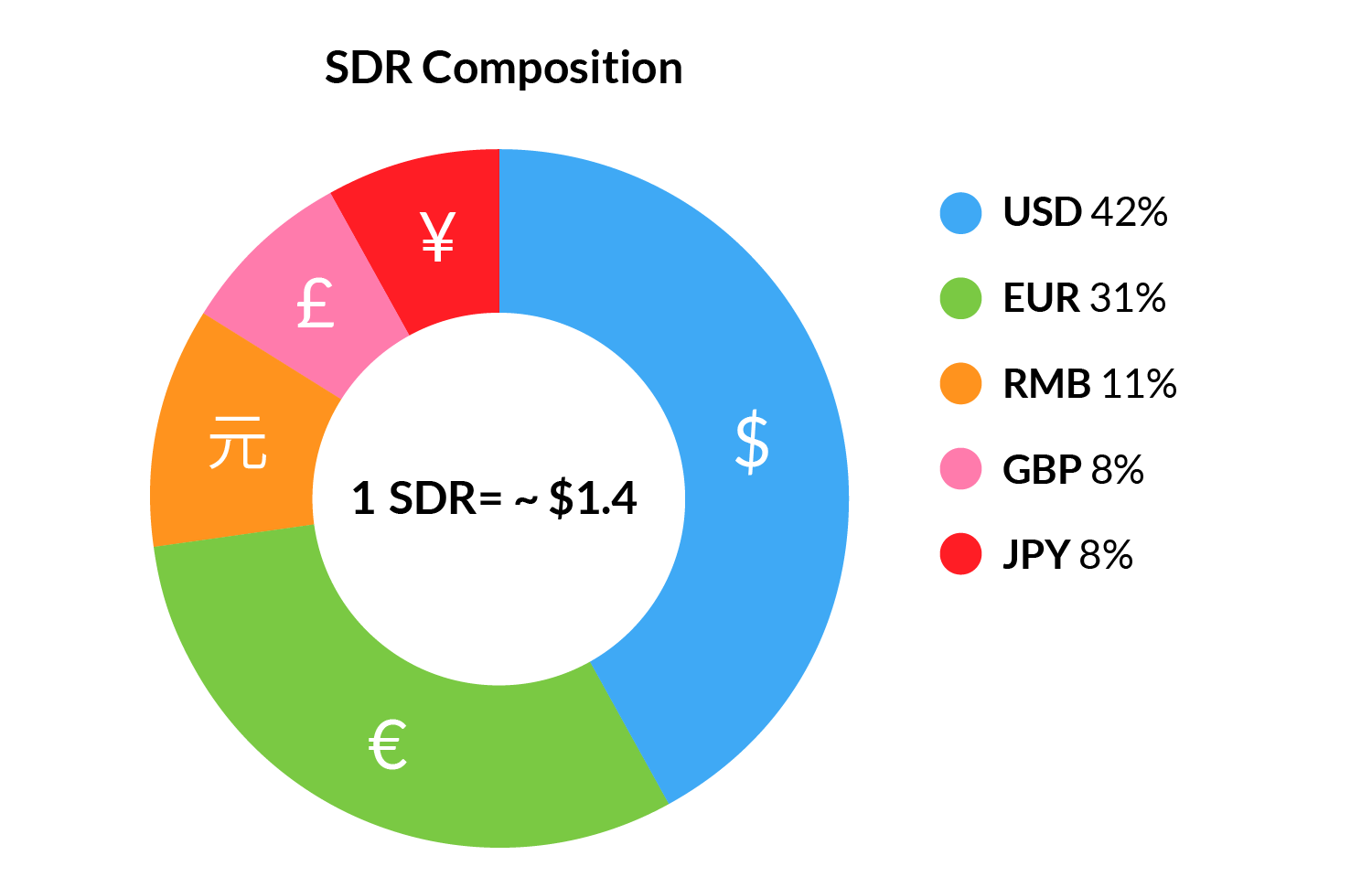

When faced with unpredictable headwinds, storing value in a single currency can come with significant risk. That’s why, for over half a century, central banks have been protecting their currencies from this risk through hedging their assets using the IMF’s special drawing rights basket of currencies. The SDR basket is comprised of the following:

SGA allows you to protect your money using the same tools as central banks. Saga’s reserve, which backs* and stabilises the SGA economy, is held in the same composition as the IMF’s SDR.

With full transparency over the value of the SDR-backed reserve, Saga has the potential to provide a safer haven for your money than other crypto assets, fiat currencies and financial instruments (see for yourself). As the events of this month have shown, the financial world can change overnight. Saga helps protect your money for tomorrow — whatever it may bring.

SGA is available for purchase here.

*SGA is a fractional-reserve currency, and therefore its price can fluctuate over time. At this stage, and until SGA reaches a market cap of $30M, the currency enjoys 100% SDR backing.