Controlled by Holders and Effective: Introducing Sögur’s Governance Model

The Sögur project began with a focus on devising the most advantageous monetary model in the crypto ecosystem. However, we soon discovered that prevalent decentralized governance solutions do not provide a viable response and that we have no choice but to develop our own governance framework.

In the process of dealing with this challenge, we came to the understanding that we need to mix together past, present, and future for designing viable governance for a global currency.

Representative institutions, recalibrated

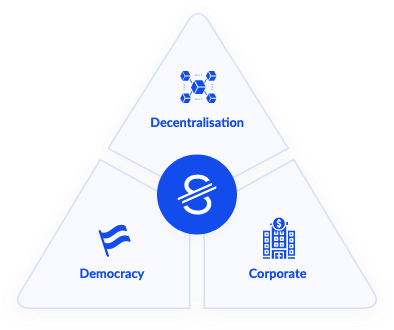

The fundamental premise of Sögur is of a social contract — designed to represent its sovereigns, the currency holders, and for carrying out their general will effectively. To achieve this we combined components from liberal nation-states, corporations, and decentralized systems.

The governance system is based on the democratic principle of separation of powers, and as such has a multi-branch structure. Each entity specializes in its respective responsibility while the system as a whole, balances between the governance entities’ powers.

Sogur’s governance structure is characterized by high liquidity, in the sense that participants’ viewpoints can be advanced into decision-making processes in real-time.

Laying out the governance system

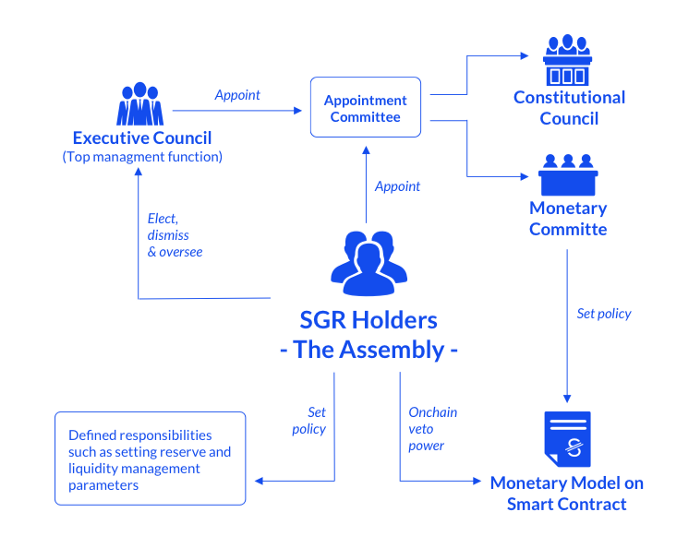

The Participants — the currency holders are Sögur’s sovereign. They exercise their sovereignty through:

(a) elections to the central executive body — the Executive Council;

(b) participation in the system’s deliberative body and operational body (over specific issues) — the Assembly.

The Executive Council is the main executive entity in Sögur’s governance system. It is a team of elected professionals in charge of managing Sögur’s ecosystem and operations; designed in the spirit of a corporation’s lean managerial body, capable of efficient and swift decision making.

We see a professional management team as a prerequisite for effective representation and for the success of the currency; specifically for making expertise-based and timely decisions. The Executive Council is also characterized by low liquidity — the Council is elected for a five-year term, allowing them adequate time to execute the agenda in which they were elected. The Council can be dissolved by the Assembly (as detailed below in the Assembly section).

The council is directly elected by holders and voting power is determined in accordance to Sögur’s Democonomy voting method, developed to dynamically balance between stake-based and participant-based voting while taking into account the concentration of holdings in the Sögur economy.

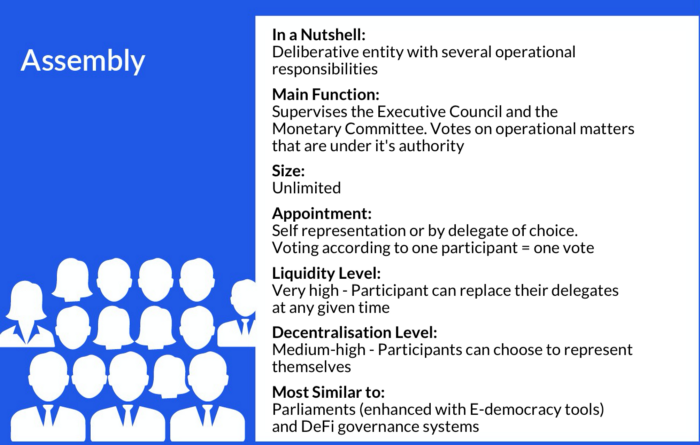

The Assembly is the deliberative entity in which Sögur’s participants can voice their opinions and make collective decisions. In addition, it has an operational role on specific matters that are under the Assembly’s authority. It is highly decentralized, as Participants can choose to either represent themselves in the Assembly or appoint a delegate, i.e. Assembly Member, to vote on their behalf.

Delegation is fully liquid and the Participants can replace their delegates at any given moment. Voting power in the Assembly is also determined by Democonomy Voting. The Assembly supervises and balances the powers of the Executive Council and the Monetary Committee. Its responsibilities and authority include:

The Assembly also appoints and guides the Transparency Committee which serves as the transparency agent for oversight and disclosure in Sögur’s ecosystem. It supports knowledge-based deliberations in the Assembly and promotes the accountability of the Executive Council and other governance entities.

The Monetary Committee is responsible for the long term stability and monetary soundness of the Sögur currency and it is authorized to determine Sögur’s monetary policy and its implementation as a smart contract. This is necessary as monetary decisions require high professional understanding and a long term outlook while the Executive Council and the Assembly may have more short term considerations.

The committee’s structure and authority are inspired by the independence of central banks and are reflected in its design and in its low level of liquidity. An ad-hoc Appointment Committee is responsible for electing Monetary Committee members. The Appointment Committee includes representatives from the Assembly, the Executive Council, and incumbent members of the Monetary Committee, promoting an expertise-based selection of candidates’ while maintaining the Participants’ representation.

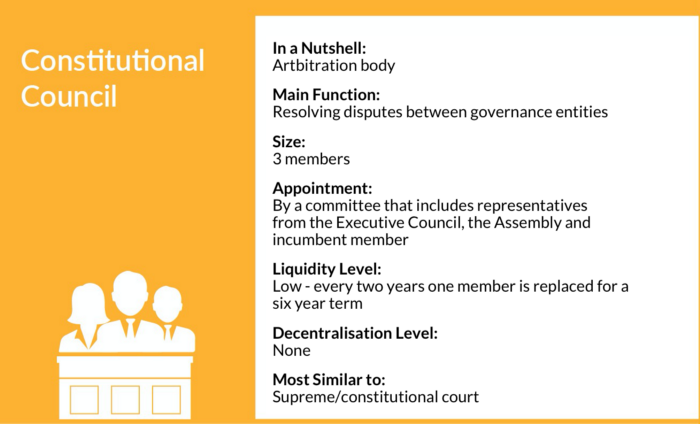

The Constitutional Council is the mandatory arbitration entity for dealing with disputes between governance entities. It can be viewed as Sögur’s equivalent to a supreme court. As part of its role, the Constitutional Council interprets Sögur’s constitution for ensuring that it is maintained. Its appointment procedures are similar to those of the Monetary Committee.

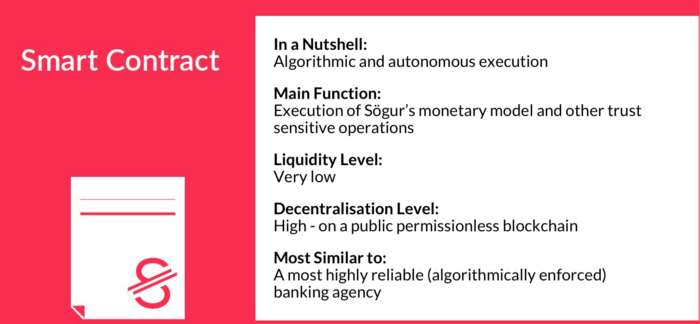

Finally, the Smart Contract is also defined as a standalone entity in Sögur’s governance. The smart contract serves to autonomously execute trust sensitive operations: implementation of Sögur’s monetary model, updating the ledger of holdings and certain voting procedures.

Its level of decentralisation is high as it runs on a public permissionless blockchain, ensuring its impartial execution. It has a low level of liquidity as some of its components are immutable (such as the ledger of holdings and transactions), while other components are open to amendments that can be initiated by the Monetary Committee. In any case, amendments take effect only after a review period in which participants can vote on-chain to reject the suggested change.

Sögur’s Constitution — Finally it is important to note that the governance model system will be sanctioned in a constitutional document that will establish the sovereignty of the currency holders, anchor their rights and delineate the governance system.

In any case, Sögur’s governance model will surely continue to evolve over time and it is specifically designed this way to support its evolution.

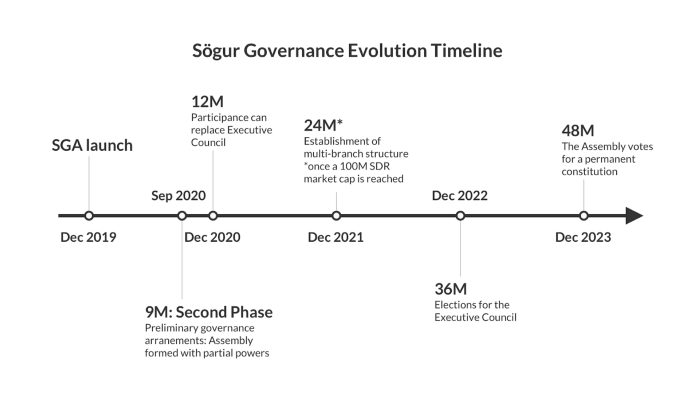

Implementation Timeline

The governance model is implemented in a series of intermediary steps. Currently, we are in Phase 2 which includes the formation of the holders’ Assembly together with a dedicated voting system.

We look forward to any comments and suggestions on the post, and you can contact us directly at research@Sögur.org.