Resolving the Stake-Based vs. Participant-Based Voting Dilemma

Written by Ido Sadeh Man, Ron Sabo, Ehud Segal

Our previous post outlined what we learned from existing governance systems when we designed Saga’s future governance model and concluded with an outline of Saga’s proposed multi-branch structure. This post focuses on a fundamental issue which ultimately determines who is represented — voting power. More specifically, we deal with a power distribution dilemma: should voting power be based on stake or should it be per participant?

In Saga, the currency holders are defined as sovereigns. But the question that immediately arises is: How should voting power be assigned among them?

Voting power: At the nexus of participants and their stakes

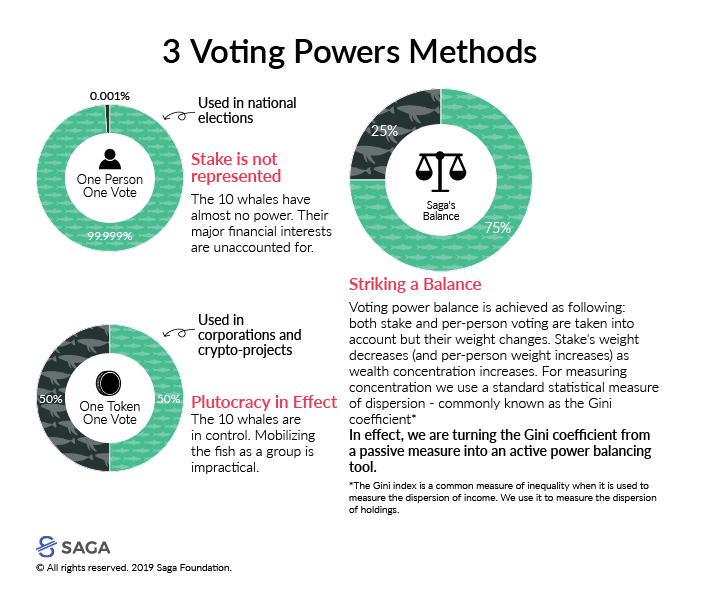

Nation states and corporations embrace opposite approaches. In corporations, as financial ventures, voting power is directly related to the number of shares held, i.e. stake-based voting. In nation-states, voting power follows the ‘one person — one vote’ principle in what we refer to as participant-based voting.

Looking at other crypto projects, most rely on stake-based voting. This is not surprising, since most of them lack the ability to establish holders’ identities, ruling out participant-based voting. In Saga, as a non-anonymous project, both stake-based and participant-based approaches are possible. So we took on the challenge and tackled the question of which voting system is most suitable for Saga, a global money aimed at representing its holders.

Getting to the bottom of the dilemma

We approach this dilemma from three directions — functionality as money, risk management and holders’ representation.

In terms of straightforward functionality, currency enjoys an inherent network effect. Each user that joins expands the network and contributes to the currency’s usefulness as a means of exchange. Therefore, the long tail of currency holders has an important contribution to the value of the currency itself regardless of the size of their holdings.

This added value should be reflected in voting power. Stake-based voting disregards this, allotting small holders less voting power than their actual significance. Similarly, a currency striving for global acceptance should incentivise users to join and take part irrespective of their holdings. Hence, tying voting power to participation in itself, i.e. to the individual as opposed to stake, is beneficial for the currency’s success.

On the other hand, allotting voting power in proportion to holdings incentivizes holders to become more involved financially in the currency, increasing the economy’s size and contributing to the currency’s function as a store of value.

So in essence, stake-based voting corresponds to the functionality of a currency as a store of value while participant based voting corresponds to the functionality of a currency as a means of exchange.

In terms of risk management, stake-based voting exposes the system to various manipulations, such as players buying voting power only to influence voting on an issue for which they have an external interest. Hostile takeovers are also a concern as the right amount of money can grant immediate control, leaving the system exposed to a constant threat to its integrity. Although, there are mechanisms based on game-theory that mitigate such risks they are limited in their effectiveness.

Participant-based voting also has its potential risks, such as a hostile takeover by organized masses. In general, such attacks are more difficult to carry out when a voting system is based on established identities. We discuss relevant defense mechanisms later in this post.

In terms of holders’ representation, stake-based voting would turn Saga’s governance into a plutocracy. The currency would be controlled by holders owning a significant part of the economy. In accordance with our vision for Saga, governance of a global currency that strives to represent its holders, must take into account the individual as the fundamental unit to be represented. Otherwise, the currency’s governance will ultimately serve other interests rather than those of holders at large.

On the other hand, SGA is a financial instrument. Hence, there is logic in that the more one is financially involved in Saga the stronger should be their say. A holder of 1M Sagas would be impacted a thousand times more by a change in Saga’s monetary policy than a holder of 1K Sagas — shouldn’t the former’s vote count much more?

The immediate conclusion that emerges from this analysis:

Voting power should attain an appropriate balance between stake-based and participant-based approaches.

Beyond the arbitrary and towards a dynamic solution

What would be the right balance between stake and participant based voting? A 50–50 weighing between them is the first option that comes to mind, but isn’t 50–50 just as arbitrary as 60–40 or 40–60?

Looking at specific scenarios provided important insights. For example, when there is no high concentration of wealth, concerns related to stake-based voting as described above are less relevant, and voting power should thus shift towards stake. In contrast, when wealth is concentrated in the hands of a few holders, the risk of plutocracy rises and voting power should shift towards participants.

So how can the distribution of holdings be used to determine voting power? Economists commonly use the Gini index as a measure for the dispersion of income. After some research and modeling, we realised that we can use the Gini index of the dispersion of holdings to balance between stake-based and participant-based voting power, in a way that provides the dynamic balance we were looking for.

Introducing dynamically balanced participant-stake voting

Our method for dynamic balancing of voting power is simple yet very effective. We turn the Gini coefficient from a passive measure of dispersion into an active power balancing tool. Although Gini is commonly known as an inequality indicator, it is actually a straightforward statistical measure for the dispersion of any given distribution. We note this to stress that we are not using it as part of any wealth distribution agenda, but rather as a practical statistical measure and as a tool for successfully dealing with the various challenges of our voting power dilemma.

For any given ecosystem of holdings, and whenever a voting process is carried out, the Gini coefficient is calculated reflecting the dispersion of holdings. The Gini coefficient (denoted G) runs between zero and one: the greater the concentration being measured, the closer the coefficient is to one. Each participant’s voting power is determined as a weighted average of the participant-based voting power (the relative part in the participant population, i.e.Vp=1/N, with N — the total number of participants) and the stake-based voting power (the relative holdings , i.e. Vs =s/T, with s the stake of a given participant and T the total stake in the system). The Gini coefficient (G) is used as the weighting factor: G*Vp + (1-G)*VS. Hence, the voting power for each participant will be equal to: G*Vp + (1-G)*VsS.

The following are several simple examples illustrating how this dynamic balancing method works while demonstrating its effectiveness.

Let’s use a story as an example

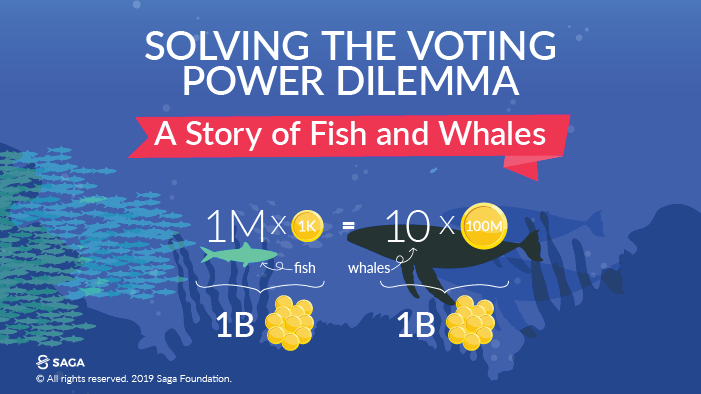

Imagine an economy consisting of 1 million users — let’s call them fish, each holding 1K tokens and additional ten users — whales — each holding 100M tokens. All of the fish combined hold one billion tokens as do the ten whales.

In a stake-based system, voting power would split 50–50 between the two types of holders. This power balance does not take into account the added value of the million fish participating in the economy.

Moreover, in practice, the whales could wield more influence, and the interests of the fish compromised, due to the mere fact that mobilising ten whales is much simpler than mobilising one million small holders. In contrast, a participant-based system would have allotted the ten whales only 0.001% of voting power, disregarding their substantial financial interests in the economy.

Now let’s apply our balancing method. The Gini coefficient of this economy is ~0.5, so the fish enjoy 75% of the voting power while the whales hold the remaining 25%. While we cannot determine that this is the optimal balance it seems reasonable and effective. For example, if the whales would want to act as a group and promote a certain policy, they would need to convince at least one-third of the fish that it is in their interests.

Now let’s prevent hostile takeovers

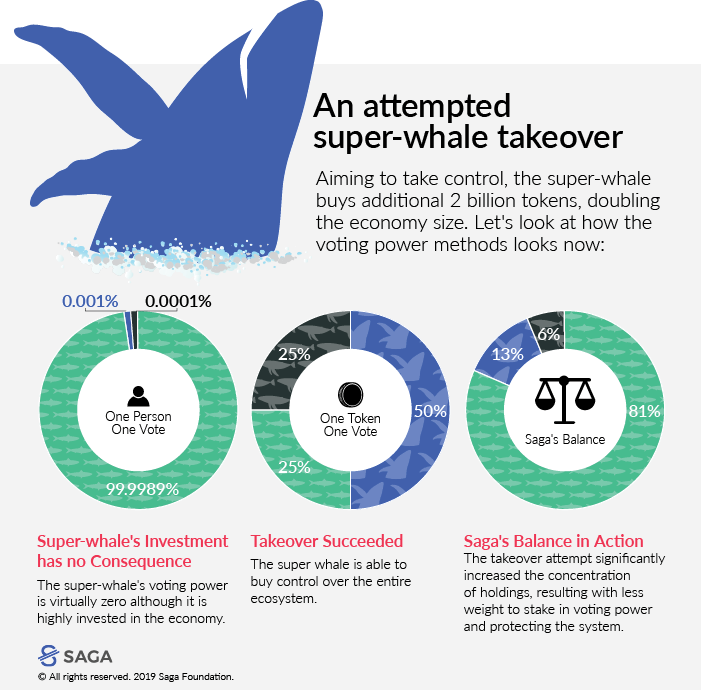

Imagine that a very big whale takes an interest in our ecosystem and wants to control it for its own purposes. He decides to buy two billion tokens, literally doubling the size of the economy. Stake-based voting would immediately afford him control over the system.

Our balancing method prevents this hostile takeover attempt. The massive acquisition by a single holder significantly increased the wealth concentration in the system raising the Gini coefficient to 0.75, shifting the dynamic weighting towards towards participant-based voting power. As a result, the super whale would only obtain 12.5% of voting power, the fish’s voting power would actually increase to 81.25% , and the ten whales would be left with 6.25%.

Even if the super-whale would manage a sybil attack by splitting his holding to 1,000 different accounts, the Gini coefficient would decrease to only 0.748, barely affecting the power balance.

But that’s not real life, is it?

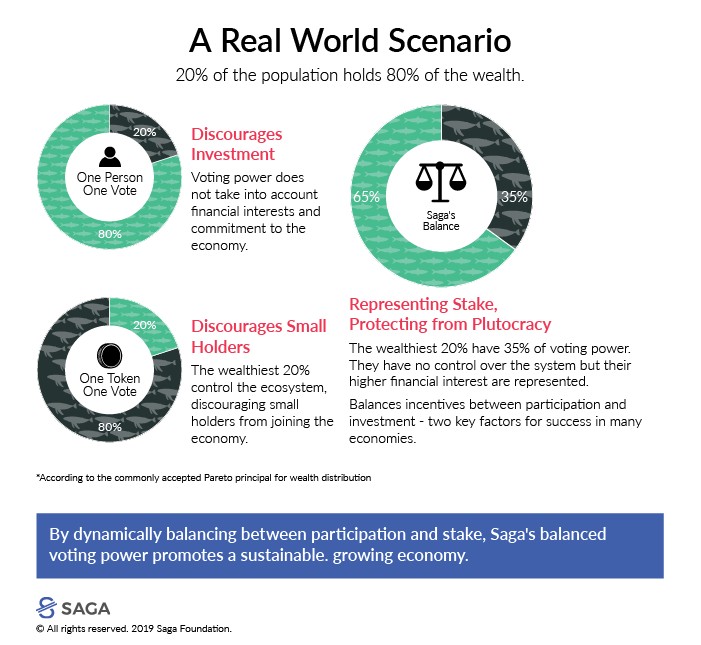

A more realistic wealth distribution is the infamous Pareto distribution, where 20% of the population holds 80% of wealth. In this setting,the top 20% with hold approximately 35% of voting power (the Gini coefficient is just a bit above 0.75). Moreover, if the concentration in the system increases, say to a 90–10 situation, the Gini coefficient also increases to more than 0.9, decreasing the voting power of stake even further.

In contrast, if concentration decreases to say a 30–70 economy (i.e where the top 30% of the population holds 70% of the wealth) the Gini coefficient also decreases to 0.54. As a result, voting power would now be divided almost evenly between the top 30% and the remaining 70%, or (52–48% in favor of the 70% to be exact).

These examples illustrate how our suggested method dynamically balances voting power in realistic distributions by actively reacting to dispersion.

Hostile fish — preventing takeovers via masses

Hostile takeovers can also be carried out by large organised schools of fish. A hostile school of fish (such as the users of a competing currency) can theoretically join the economy in order to disrupt it and even destroy it. This risk is mitigated by setting a minimal holding threshold coupled with a qualifying holding period for participation in voting, making such attacks expensive and providing time for retaliation.

Matchmaking governing entities to voting methods

As mentioned in part II of this series, Saga’s proposed governance structure is based on separation of powers in a multi-branch structure. The two main entities are: the Foundation Council — an elected small team of professional executives responsible for managing the currency; and a representative entity — the Assembly, with responsibility for monitoring, scrutinising and in extreme cases even dissolving the Foundation Council.

The power balance between the Foundation Council and the Assembly and their respective roles is also manifested in the voting power methods they are based on. Activity in the Assembly, as a representational entity, is based on per participant voting — setting the individual as the fundamental unit of representation. Elections for the Foundation Council, on the other hand, are based on the dynamically balanced participant-stake voting method explained above.

We think it appropriate that all holders should be equally represented in the designated representative entity while stake should have a balanced role in choosing the management team.

When it comes to choosing officials for positions in which expertise is of most gravity, as in the Monetary Committee and the Constitutional Council, we opted for an appointment mechanism by a small selection body, allowing a proper assessment of the candidates’ expertise. For this we designed an Appointment Committee that includes representatives from both the Foundation Council and the Assembly, allowing Saga holders indirect influence on the appointment process.