Reserve Attestation — What You Need to Know

The performance page on our website includes a reserve attestation section where we provide reports on the value of Saga’s reserve and its deployment.

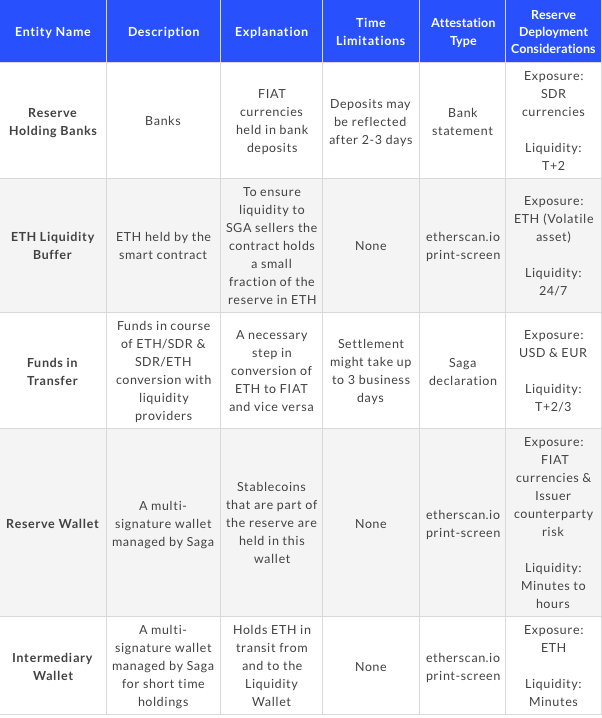

The reserve reporting is updated on a daily basis with the most up to date data each day. While the crypto markets are “open” 24/7, traditional financial markets (where a significant part of the reserve is held) work only during the relevant business days and hours. Moreover, settlements and fund transfers may take up to 3 business days. This is why the reserve attestations are updated on business days only and, depending on the reserve holding entity, might reflect the attestation for previous days. In addition, we separately report on “funds in transfer” (explained below).

When designing how the reserve would be deployed, we had to balance between three conflicting goals:

Reserve Holding Entities

To balance the conflicting targets mentioned above, a three-phase reserve deployment plan is in place:

1. Reserve value under $2M

2. Reserve value between $2M and $10M

3. Reserve size greater than $10M

At least 90% of the reserve is held in banks. Up to 5% is held in the ETH liquidity buffer and the rest is held in stablecoins.

With the continuous growth of Saga’s economy, the portion of the reserve held in banks increases.

*Reserve deployment guidelines changes will be reflected on this page.